- 行业新闻

-

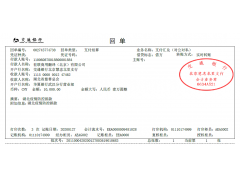

北京翻译公司完成金融类英文翻译

发布时间:2018-02-02 08:45 点击:

北京翻译公司完成金融类英文翻译On behalf of a multi-billion US domiciles sovereign wealth fund, HarbourVest manages a traditional private equity discretionary separate account that is broadly diversified primary private equity investments. HarbourVest's goal over the five year program is to achieve superior returns for the separate account client while reducing risk through appropriate diversification. The five year strategic plan is outlined as part of the Investor Management Agreement (“IMA”).

To implement this approach, annually a Tactical Allocation plan is created and approved by the clients’ investment staff. This plan serves to provide an overview of the program’s long-term objectives over the five year IMA, as well as the tactical plan for each fiscal year. Manager selection and sector weightings for each fiscal year are completed in consideration of the global, marcro private equity environment and executed in-line with HarbourVest’s long-established investment approach. To this end, an overview of market activity and an outlook for each segment is provided. HarbourVest employs a strategy mix of venture capital and buyout investments for fiscal year. An appropriate component of international will also be incorporated.

HarbourVest endeavors to achieve its investment objective by an annual selection of experienced private equity management teams, diversified by the geographic focus, industry, and stage. We intend to make commitments to a select number of managers each year through a top-down, macro allocation strategy and rigorous, bottom-up manager due diligence process. Private equity fund managers typically make investments over a three to five year period, which creates additional time diversification and should be taken into account when balancing annual allocations within a five-year strategic plan.

VENTURE CAPITAL: Targeting 20-30% of total committed capital.

- Emphasis on proven, established venture capital partnerships focused on early-stage investing.

- Exposure to later-stage venture capital and growth equity funds on a select basis.

- Diversified with respect to region, industry, and technology focus of the individual partnerships, the size of the partnerships, the various stages of company developments in which they invest, and the transaction sizes of the investments made by the partnerships.

- Emphasis on investments in control-oriented buyout partnerships, in particular small and middle-market focused partnerships managed by sponsors with a demonstrated ability to improve portfolio company operations and cash flow.

- Select exposure to larger buyout funds with similar attributes.

- Diversified with respect to region, industry, and technology focus of the individual partnerships, the size of the partnerships, the various stages of company developments in which they invest, and the transaction sizes of the investments made by the partnerships.

- Emphasis on investments in established private equity managers in developed economies with a proven, successful track record of private equity investment.

- Commitments outside of the U.S. are primarily with Western European-based, middle-market private equity managers.

- Focus on control-oriented managers for Asia Pacific and Emerging Markets.

- Diversified with respect to region, industry, and technology focus of the individual partnerships, the size of the partnerships, the various stages of company developments in which they invest, and the transaction sizes of the investments made by the partnerships.

北京翻译公司,天津翻译公司,郑州翻译公司,西安翻译公司,重庆翻译公司,长沙翻译公司,济南翻译公司,青岛翻译公司,